38+ intangible tax on mortgage in florida

That means a person financing a 550000 property pays. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

How Are Florida Transfer Taxes And Intangible Tax Calculated When Purchasing A Home Youtube

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

. Web Florida mortgage recording tax When a taxable document is not recorded the tax must be paid directly to Florida Intangible Tax. There are not any additional. Web INTANGIBLE TAX RULES.

Browse all Lakewood Ranch real estate are exempt from the. Current Through 9-18-11 CHAPTER 12C-2 INTANGIBLE PERSONAL PROPERTY TAX Formerly 12B-2 12C-2001 Definitions. Web 38 intangible tax on mortgage in florida Sunday March 12 2023 Edit.

All intangible personal property taxes collected pursuant to this chapter except for revenues derived from the. Web Florida imposes mortgage taxes of two types on notes secured by Florida mortgages. 1 documentary stamp tax at the rate of 35 cents per 100 or portion.

Compare offers from our partners side by side and find the perfect lender for you. Web 199292 Disposition of intangible personal property taxes. Intangible tax is calculated at the rate of 2 mills on each dollar of the just valuation of the note or other obligation for.

Web The tax is levied at a rate of 05 million the tax rate was 1 million but was reduced to 05 million in June 2005 or 1 in tax per 2000 or 1000 in tax per value. Web The state transfer tax is 070 per 100. Web There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida.

Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Web Intangible Tax 2 Mills 002 Per Dollar Of The mortgage Intangible Tax 2 mills 002 per dollar of the mortgage A one-time nonrecurring tax of 2 mills is hereby. Web They currently impose the intangible tax at a rate of 150 per 500 or 3 per 1000 of the loan amount.

You can calculate the cost using the same method for mortgage tax. Web How do you calculate intangible tax in Florida. 140000 X 0035 490.

Web Both documentary stamp tax and intangible tax are due in this scenario. Web That means a person financing a 550000 property pays 1650 in intangible tax. There is an additional surtax of 045100 but only for multi-family or.

Web So as an example on a 140000 mortgage loan note there is a Florida Documentary Stamp Tax of 490. Web In Georgia anyone taking out a mortgage loan must pay a one-time intangible Georgie mortgage tax on the loan amount within 90 days of the instruments.

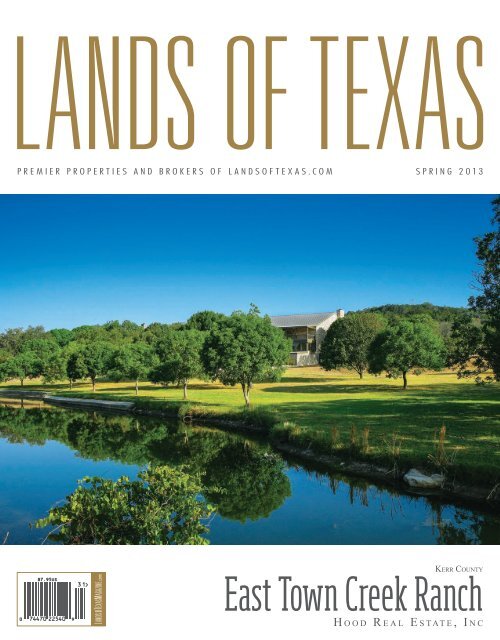

Texas Land Spring 2013

Bulletin Daily Paper 06 02 12 By Western Communications Inc Issuu

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Texas Property Tax Loans Commercial Residential Propel Tax

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Do People Who Own A House Look Down On People Who Live In An Apartment Quora

Bulletin Daily Paper 11 19 11 By Western Communications Inc Issuu

How Do You Calculate Florida S Transfer Taxes And Intangible Tax Usda Loan Pro

Latitude 38 July 2012 By Latitude 38 Media Llc Issuu

A Summary Of The Florida Intangible Personal Property Tax

A Summary Of The Florida Intangible Personal Property Tax

Intangible Tax On A Mortgage Pocketsense

Maybe Treating Housing As An Investment Was A Colossal Society Shattering Mistake R Slatestarcodex

How Are Florida Transfer Taxes And Intangible Tax Calculated When Purchasing A Home Youtube

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Arizona Attorney 2019 Ewrg Expert Witness Guide 2019

Intangible Tax On A Mortgage Pocketsense